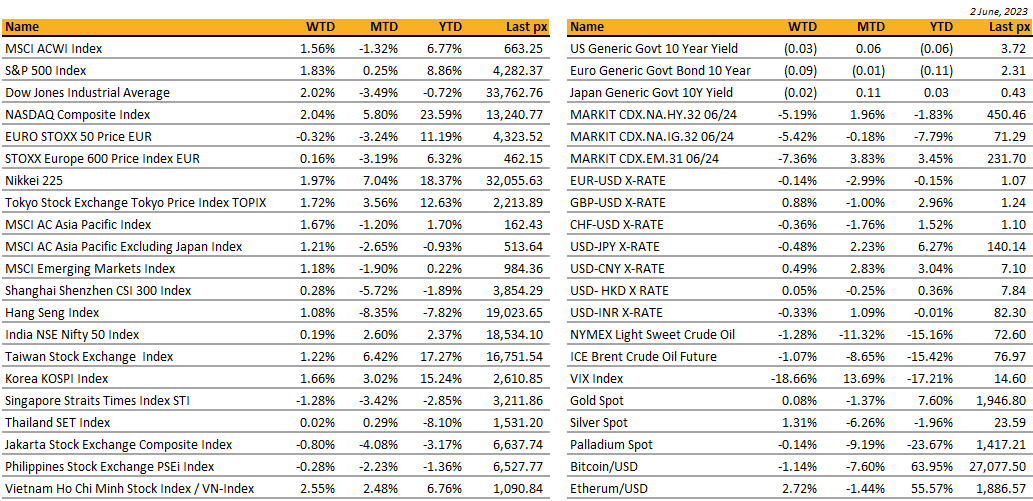

KEY MARKET MOVES

MACRO OVERVIEW

Global

June started off on its front foot, with all major indices ending positively. The Dow, S&P 500 and Nasdaq Composite all ended up around 2% for the shortened week.

The boost came after Congress passed the debt-ceiling suspension, clearing one of the market’s main headwinds. The debt-limit bill would suspend the debt ceiling until January 1st, 2025 in exchange for caps on federal spending on defence and domestic programs into 2025. On Saturday, President Biden signed the bill.

Economic data released Friday showed a still robust employment situation albeit an unemployment rate that rose to 3.7% from 3.4%. NFP easily beat expectations at +339k jobs but the weakness in the “household survey” report showed jobs falling by 310k in May and an unusually large increase in the unemployment rate supports a pause in June. Also, the report showed a downtick in hours worked to 34.3hrs, with weekly hours now tracking down 0.2% (annualized) relative to its Q1 average, which would mark the first quarterly decline since the start of the pandemic. Supporting the pause narrative came from voting-members Fed Governor Jefferson and Philly Fed President Harker who signalled earlier this week the Fed could skip hikes at the June meeting to assess incoming data but was careful to note that a potential skip wouldn’t imply an end to the tightening cycle. A further ammunition for the Fed to persist with a pause comes in the excess savings on consumer’s balance sheets observation. During the pandemic, consumers saved some $2.2 trl according to Jefferies. This amount has dwindled to around $822 bln. The expected slowing in the labour market going forward at a time when savings are dwindling makes a pause by the Fed credible, according to Morgan Stanley. The JOLTs report surprised to the upside showing layoffs declined significantly last month.

Factory activity shrank for a 7th month in May as orders contracted and material costs fell – ISM manufacturing slipped further to 46.9 from 47.1. Consumer confidence fell to a 6-month low as business outlook conditions continue to deteriorate, with the share of consumers who said jobs were “plentiful” fell to the lowest in more than 2 years. This week will see less hectic data with only ISM data, factory orders and durable goods of significance.

In investments: The rally we have seen has been mainly AI-Tech driven. So far, there’s no sign of any let-up as LT yields continue to drift. Technical bull trigger for the SP 500 at +20% from October 2022 lows would be the next trigger for further upside momentum. We are taking a view to start partially hedging downside risks closer to 4300.

Asia

Asian markets inched a gain last week, but not enough to pull up May’s performance, or YTD performance. MSCI Asia Ex Japan index closed the month of May down 2.65%, and is still down 0.93% since the start of 2023.

A wobbling economic recovery, intensifying geopolitical tensions and a weaker yuan have been keeping global investors away from Chinese markets. A rebound for its equities would require a monetary catalyst or improving ties between Beijing and Washington. Hong Kong’s Hang Seng index fell another 1.9% mid-week, on the back of a weaker-than-expected PMI data; pushing benchmark 19.7% down from January peak and close to technical bear market before respite over the debt deal propped some support.

Official manufacturing purchasing managers’ index (PMI) in China fell to 48.8 from 49.2 in April, according to data from the National Bureau of Statistics (NBS), its lowest in five months and below the 50-point mark that separates expansion from contraction. Service sector activity expanded at the slowest pace in four months in May, with the official non-manufacturing PMI falling to 54.5 from 56.4 in April.

The private Caixin PMI however, this morning shows China Services Sector Rebounding to 57.1, for a fifth straight month. Caixin/S&P’s composite PMI, which includes both manufacturing and services activity, picked up to 55.6 from 53.6 in April, marking the quickest expansion since December 2020.

Japan’s service sector activity expanded at a record pace to 55.9 in May, a private-sector survey showed on Monday, thanks to a recovery in overseas demand and a surge of foreign tourists as pandemic restrictions were eased further. The number of foreign visitors to Japan climbed to a post-pandemic high of nearly 2 million in April. The composite PMI, which combines the manufacturing and services activity figures came in at 54.3, staying above the 50 mark for a fifth straight month.

BOT raise rate by 25bps to 2%, the highest level in eight years although headline inflation has eased every month since Jan and returning within BOT’s 1-3% target in Mar. Key risks to inflation are increased consumption from a tourism led pickup in economic activity and possibly higher spending by the new government. April export -4.9% with current account deficit $476m.

GDP grew 6.1% in India. The strong growth was driven by a pickup in domestic demand for goods and services as well as strong exports. The Reserve Bank of India has raised its benchmark interest rate by 250 basis points since May last year, and economists expect it to leave the rate unchanged for the rest of 2023. Prime Minister Narendra Modi, who remains popular after nine years in power, has stepped up capital spending in the past few years to build roads, railways and new airports to revive the economy after the pandemic.

Lending in Vietnam’s banking system rose 3.17% as of May 31 vs growth of nearly 8% a year earlier. The weakness was attributed to slowness in credit growth to businesses’ reduced production due to lack of orders, fewer real estate projects being implemented because of developers’ struggles and some small, medium enterprises failing to meet lending requirements due to weak financial health. Vietnam’s economy showed signs of stabilizing after the government rolled out several measures and the State Bank of Vietnam cut the policy rate by 100 bps in March and 50 bps in May. The Vietnam index is up 6.7% YTD.

Inflation in Australia continues to exceed market expectations, rising in April 2023. Data from the Australian Bureau of Statistics (ABS) showed that on an annual basis inflation rose to 6.8 per cent, up from 6.3 per cent the month prior. The increase largely surprised market expectations and increases the chances that the Reserve Bank of Australia will increase the official cash rate when it meets next week.

Geopolitics – US/ China/ Chips

Early last week, China rejected an American request for a meeting between the countries’ defence chiefs to be held in Singapore.

China’s commerce minister Wang Wentao urged Tokyo to ‘correct its wrongdoing’ of imposing chip export control on China. Wang made the comments in talks with Japan’s economy and trade minister during the APEC conference Friday, adding Tokyo has “seriously violated” international economic and trade rules”

Commerce Minister Wang also met with his South Korean counterpart at APEC, saying later Beijing and Seoul had agreed to strengthen cooperation on semiconductor supply chains. But Bloomberg also reported Seoul will not encourage its chip firms to grab Micron’s market share despite a Financial Times report last week that said it would not intervene in attempts to win share.

Musk and several other top CEOs are visiting Beijing for a JP Morgan conference. Elon Musk met with China’s Foreign Minister Qin Gang on Tuesday. Global corporate leaders expressed commitment to continue to invest and operate in China – including Jamie Dimon, Elon Musk, Starbucks CEO Laxman Narsimhan last week, and Nvidia and LVMH CEOs who are scheduled to visit in June.

Beijing, Shanghai and Shenzhen, the three key top-tier cities in China, issued multiple plans last week about the development of artificial intelligence (AI) and its integration with different sectors

China also mulls over new tax incentives for high-end manufacturing companies as Beijing seeks to bolster the economy and encourage more innovation in technology to counter US competition. The tax policy being considered could save advanced manufacturers hundreds of billions of yuan. The plan is still subject to approval and could change.

CREDIT / TREASURIES

US Treasuries fell last week and bear flattened, with markets now pricing in around 7.5bps of hikes for the June meeting and 20.5bps by July.

Fitch might cut the US’s credit rating even with the debt ceiling deal. A downgrade of US debt would make borrowing more expensive for businesses and put jobs at risk.

Asia HY, China property bonds were 1-4pts higher. Country Garden, Gemdale, Shui On, Future Land, Road King, were well sought after. Agile, SCE, South City had some two way interest. It was mainly higher on the back of stimulus optimism.

FX

DXY USD fell 0.18% to 104.015 despite the Senate approving a measure to suspend debt ceiling limit through January 1, 2025, as more Fedspeak suggested the FOMC may pause its tightening cycle in June. In the US, we have a large upside surprise in May non-farm payrolls, although underlying details of the jobs report were mixed. Non-farm payrolls increased by 339k (C: 195k; P: 294k), with upward revisions of +93k across March and April. However, employment in the household survey fell by 310k and pushed the Unemployment Rate up to 3.65% (C: 3.5%; P: 3.39%). ISM Manufacturing PMI came in at 46.9 in May (C: 47.0; P: 47.1). Prices Paid fell sharply to 44.2 (C: 52.3; P: 53.2), its lowest level since January 2023.

EURUSD fell 0.14% to 1.0708, as Euro area inflation surprised to the downside at 6.1% y/y (C: 6.3%; P: 7.0%). The Unemployment Rate came in at 6.5% in April (C: 6.5%; P: 6.6%), while the final Manufacturing PMI came in at 44.8 in May (C: 44.6; P: 44.6).

GBPUSD rose 0.88% to 1.2453 due to positive risk sentiment. Data wise, UK Manufacturing PMI for May final came in at 47.1, above consensus of 46.9.

USDJPY fell 0.48% to 104.02, as it was announced that Japan’s MoF, BoJ, and FSA held their first tri-party meeting since March. Expectations that BoJ might action to limit JPY weakness cause JPY to strengthen broadly. In addition, the fall in UST yield across different tenors added to USDJPY downside. Data wise, JP jobless rate came in at 2.6%, below consensus and retail sales MoM came in at -1.2% (C: 0.5%).

Oil & Commodity

Bloomberg Commodity Index fell 0.26% as WTI and Brent fell 1.28% and 1.07% as of Friday close, given China weak PMI. However, over the weekend, Saudi Arabia pledged an extra 1 million b/d supply cut in July at OPEC+ meet, taking its production to the lowest level for several years following the slide in oil prices. Oil prices are trading with an upward bias this morning. More weakness in China PMIs led to an expectation for imminent stimulus to the property sector, with commodity prices rebounding from its low. Iron Ore rose 8.39% last week, while Copper rose 1.47%. Gold price was relatively unchanged last week (+0.08%), closing at 1947.97.

ECO

M – AU/JP/CH/SW/EU/UK/US Svc/Comps PMI May Final, AU Inflation MoM, SZ CPI, EU Sentix Inv. Confid./ PPI, US Factory Orders/ Durable Goods Orders/ ISM Svc Inx

T – NZ Commodity Price. AU RBA OCR, EU Retail Sales, CA Building Permits

W – AU GDP, SZ Unemploy. Rate, NO Indust. Pdtn, US Mortg. App./ Trade Balance, CA BOC Rate Decision

Th – JP GDP/ BoP Balance, AU Trade Balance, EU GDP, US Initial Jobless Claims

F – CH CPI/PPI, NO CPI, CA Unemploy. Rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.