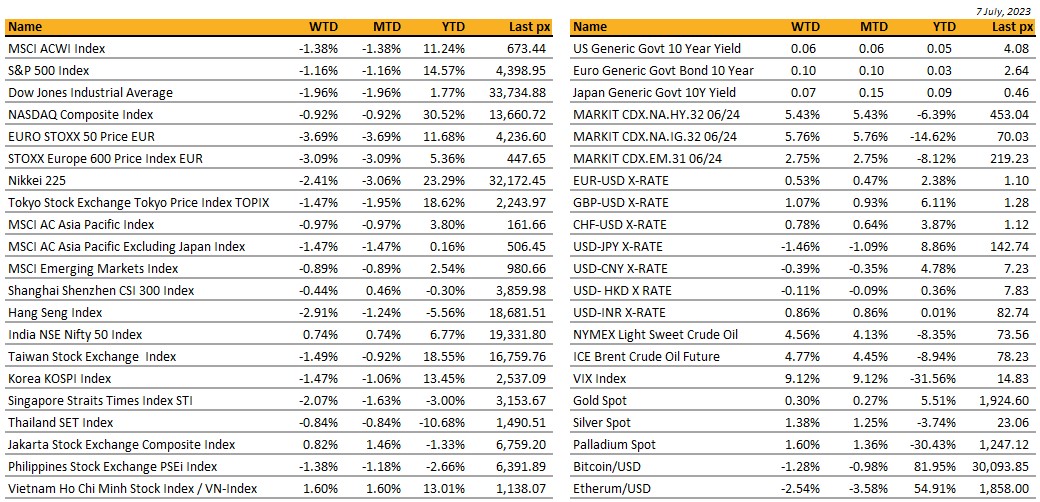

KEY MARKET MOVES

MACRO OVERVIEW

Global

US markets posted its first weekly decline in as many months as the Fed hyped up talks of further rate hikes and contrasting jobs reports. All 3 major indices fell on Friday after wavering between gains and losses all day, the VIX closed higher at 14.83. Earlier in the shortened week, the ADP private payrolls showed the pace of job growth unexpectedly accelerated with a blowout +497k change versus expectations of +225k which reinforced bets on further Fed tightening. Widely expecting Friday’s employment data to follow in lock-step, NFP came in at an underwhelming +209k against views of 230k. Both the unemployment and participation rates were on the nose at 3.6% and 62.6% respectively. The main concern was in hourly earnings which came in higher than expected. The JOLTs for May dropped below 10 mln to 9.82 mln where new hires rose to 6.21 million from 6.1 million, quits jumped up to 4.02 million from 3.77 million and layoffs dipped to 1.56 million from 1.59 million.

The Fed has been hoping to see more slack in the labour market, since an imbalance between worker demand and supply could cause wages to rise and, ultimately, add upward pressure to inflation. US Treasury yields spiked higher with the 2’s and 10’s closing at 4.9459% and 4.0616% respectively. Factory orders and ISM data (expectedly) underwhelmed. After a stellar first half rally, a pullback in stocks should not really be unexpected. Fed minutes from June 14th showed officials were split over the June rate pause with the majority pencilling in another rate hike this month, hence the higher dot plots.

Bloomberg reported over the weekend that bearish positions in exchange-traded funds slipped to three-year lows while shorts in S&P 500 futures were unwound at the fastest pace since 2020. This means shorts are being or, have been unwound, providing less of a tailwind for stock bulls going forward. Or, is it? Q2 earnings start this week with big banks kicking it off and analysts expect a 9% contraction in Q2 profits for S&P 500 firms. US Treasury Secretary Yellen who was in China during the week, struck a positive but pragmatic tone after completing her high-stakes trip to China. She described the talks to be “direct, substantive” and had brought US-China ties closer to a “surer footing”. This week will see the release of CPI expected at 3.1% headline and 5% core YoY on Wednesday followed by PPI on Thursday.

M2 money supply in the US was standing at USD 15.3T pre-Covid compared to USD 20.8T now. This reduction of M2 will continue in the coming Month and at the same time, Fed QT will also continue. There is currently still ample liquidity in the market, some liquidity are parked with the Fed into their Reverse Repo facility. Jamie Dimon, CEO of JP Morgan, recently said that the only thing that keeps him up at night is the withdrawal of liquidity. The last time the Fed began QT, it led to a major spike in overnight repo rate in 2019. We have seen how QE was supportive of asset prices in the past. QT and withdrawal of liquidity might, at some point, could have the reverse effect.

Asia

Last week, Asian markets concluded with a decline, as evidenced by the MSCI Asia ex Japan index decreasing by approximately 1%. Hong Kong’s Hang Seng index led the weakness, declining by 2.9% over the week.

In China, the Caixin services Purchasing Managers’ Index (PMI) for June fell short of expectations but remained above the expansionary threshold. It dropped to 50.5, down from the 50.9 reported in May. Business confidence in China also reached an eight-month low during June. Furthermore, input prices experienced their sharpest decline since January 2016, attributed to weaker-than-anticipated demand coupled with improved supply conditions.

Additionally, data released this morning revealed China’s annual producer deflation deepened in June, while consumer prices remained flat. Producer prices plunged by 5.4% compared to the same period last year and decreased by 0.8% from the previous month. These figures provide fresh evidence of slowing economic growth, indicating that the measures taken to ease monetary policy have been insufficient in revitalizing and sustaining China’s recovery since its reopening post Covid.

Consumer price index, CPI, in South Korea rose 2.8%, dipping below 3% for the first time in 21 months. Unemployment rate in South Korea is at record lows and current account also turned to a surplus last month. Weak exports, signs of improvement in inflation and consumer spending have encouraged the Government to loosen lending requirements for landlords while extending financial support and tax breaks for exporters.

BOJ (Bank of Japan) Deputy Governor Uchida commented that they plan to continue with the Yield Curve Control (YCC) strategy to maintain lenient monetary conditions. He emphasized that there is a considerable distance to cover before considering rate hikes and affirmed that there are no plans to modify the 2% inflation target.

Thai prime minister candidate Pita Limjaroenrat appealed to the country’s lawmakers to back his bid for the top job, as he rallied supporters in central Bangkok days before a pivotal parliamentary vote to pick the country’s next leader on Jul 13th. Hundreds of supporters rallied in the capital on Sunday ahead of a parliamentary vote.

Geopolitics – US/ China/ Chips

US Treasury Secretary Janet Yellen visited China from 6-9 July with goal of finding economic common ground and opening communication channels. “The US and China have significant disagreements,” Yellen told reporters at the US Embassy in Beijing, citing her government’s concerns about what she called “unfair economic practices” and Beijing’s recent punitive actions against US firms. “But President Biden and I do not see the relationship between the US and China through the frame of great power conflict. We believe that the world is big enough for both of our countries to thrive,” she said. She reiterated that Washington was not seeking to decouple from China’s economy as doing so would be “disastrous for both countries and destabilising for the world”.

Yellen’s visit comes days after China imposed export restrictions on key chip-making metals. The commerce ministry announced Monday that starting Aug. 1 China would restrict exports of gallium and germanium — two metals used in semiconductor manufacturing. That means companies in China need to apply for licenses to export the metals.

India’s trade minister will hold talks in the UK on a free trade deal with Britain and meet ministers from the European Free Trade Association from July 10 to 11. Trade minister Piyush Goyal will meet with his UK counterpart, Kemi Badenoch, as well as representatives from British industry. Goyal will also meet ministers and officials from the European Free Trade Association, which comprises Switzerland, Norway, Iceland, and Liechtenstein, to assess progress toward reaching a Trade and Economic Partnership Agreement with them.

CREDIT/ TREASURIES

The US Treasury curve bear steepened during the week, the 2years yield gained 3bp, the 5years yield gained 19bps, the 10years yield gained 22bps and the 30years gained 18bps. Both the 10 & 30years traded above 4% for the first time since early March and before the stress on regional financial institutions in the US started.

Credit spreads on US IG widened by 3bps while credit spreads on US HY widened by 21bps over the week. US IG lost 1.80% over the week while US HY lost about 1%. Leverage loans managed to end the week positive gaining 15bps.

China’s largest state banks are offering long-term loans and temporary interest relief to Local Government Financial Vehicles (LGFVs) to prevent a credit crunch. The loans have maturities of 25 years and waivers on interest and principal payments for the first four years. This move aims to address the refinancing needs of LGFVs and avoid relying on large stimulus packages. It reflects concerns over financial fragility in China’s economy and potential defaults at the government level.

Chinese banks have stopped buying bonds issued in the Shanghai FTZ or free trade zone, after regulators increased scrutiny. About USD 18bn new debts have been launched over the last 9Months in the Shanghai FTZ. The PBOC in May told lenders that they can only buy bonds sold in the Shanghai FTZ if the issuers have genuine business operations in the area. There hasn’t been a single FTZ bond sold after June 16. The move will hit debt laden LGFVs the hardest as they have dominated FTZ bond issuance this year. Higher overseas borrowing costs and increased domestic credit market volatility have made issuance in the hybrid onshore-offshore market a preferred alternative, especially for LGFVs facing massive refinancing needs this year. We will continue monitoring closely this evolving situation on LGFV’s refinancing moving forward as, if not managed properly, it could have a huge negative impact on the whole Chinese economy due to its massive size and opacity.

FX

DXY USD Index fell 0.62% to 102.27 as Non-farm payrolls disappoints at 209k (C: 230k). Unemployment rate came in in-line at 3.6%, while average hourly earnings came in higher than expected at 0.4% mom and 4.4% yoy. ISM manufacturing lower than expected, but ISM services index higher than expected. ISM price paid down 2.4 points to 41.8, lowest since covid. FOMC minutes indicated that almost all members want to hike again, and hawkish minutes reinforce the likelihood of a 25 bps move July 26. Fed staff economist continued to forecast a mild recession starting later this year, at odds with Fed Chair expectation for slow growth. Support level at 102 / 100.80.

EURUSD rose 0.53% to 1.0967 due to below consensus US Non-farm payrolls. Final EU manufacturing PMI came in below expectation at 43.4, bringing the final composite PMI at 49.9. EU retail sales mom lower than expected at 0.0%. Resistance level at 1.10 / 1.11.

GBPUSD rose 1.07% to 1.2839 due to below consensus US Non-farm payrolls. Final UK manufacturing PMI came in slightly above expectation at 46.5, while final services and composite PMI came in in-line. Resistance level at 1.285 / 1.30.

USDJPY fell 1.46% to 142.21 due to broad based USD weakness as non-farm payrolls disappoint, despite short term US yields rising last week. USDJPY fell almost 2 big figures last Friday, as stop loss was triggered given that USDJPY is trading at overbought territory. Immediate support level at 142 / 140.

Oil & Commodity

Bloomberg Commodity Index rose 0.43%. Gold price rose 0.30% to 1925.05, while silver rose 1.38% due to broad based USD weakness. WTI and Brent both rose more than 4% last week, as OPEC+ cuts take hold. Saudi Arabia’s pledge last week to keep its output cuts in place for August, while Russia announced export curbs to help prop up prices. US to buy 6 million more barrels of oil for the strategic petroleum reserve, to slowly refill the emergency stockpiles, adding to oil price upside.

China has announced new restrictions on gallium and germanium exports, both key semiconductor inputs, effective August 1. China is easily the world’s dominant producer of both, and the restriction pushes the global economy one step closer to high-tech decoupling.

We are looking at commodities and copper comes to mind. With rising usage of EV’s globally, copper is a key pillar of its bullish story. “Due to copper’s highly conductive and ductile nature, it is an ideal candidate for transformation and transmission of electrical energy in EVs,” (GS, 7/7/23). Two ways to articulate this view: via an ETF Wisdom Tree Copper ETF (COPA LN) or participation notes on LMCADY a daily cash-fixing non-futures Copper price.

ECO

M – JP BoP, CH CPI/PPI, NO CPI, EU Sentix Inv. Confid., US Wholesale Inv.

T – AU Cons. Confid./ Biz Confid., JP Machine Tool Orders, UK Employ. Rate, , EU ZEW, US Small Biz Optim.

W – JP PPI/ Core Machine Orders, NZ RBNZ OCR, US Mortg. App/ CPI, CA BOC Rate Decision

Th – NZ Biz Mfg/ Food Prices, AU Cons. Confid., UK GDP/ Indust. Pdtn/ Mfg Pdtn/ Trade Balance, EU Indust. Pdtn, US PPI/ Initial Jobless Claims

F – JP Indust. Pdtn, SW CPI, EU Trade Balance, CA Mfg sales, US Mich. Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.