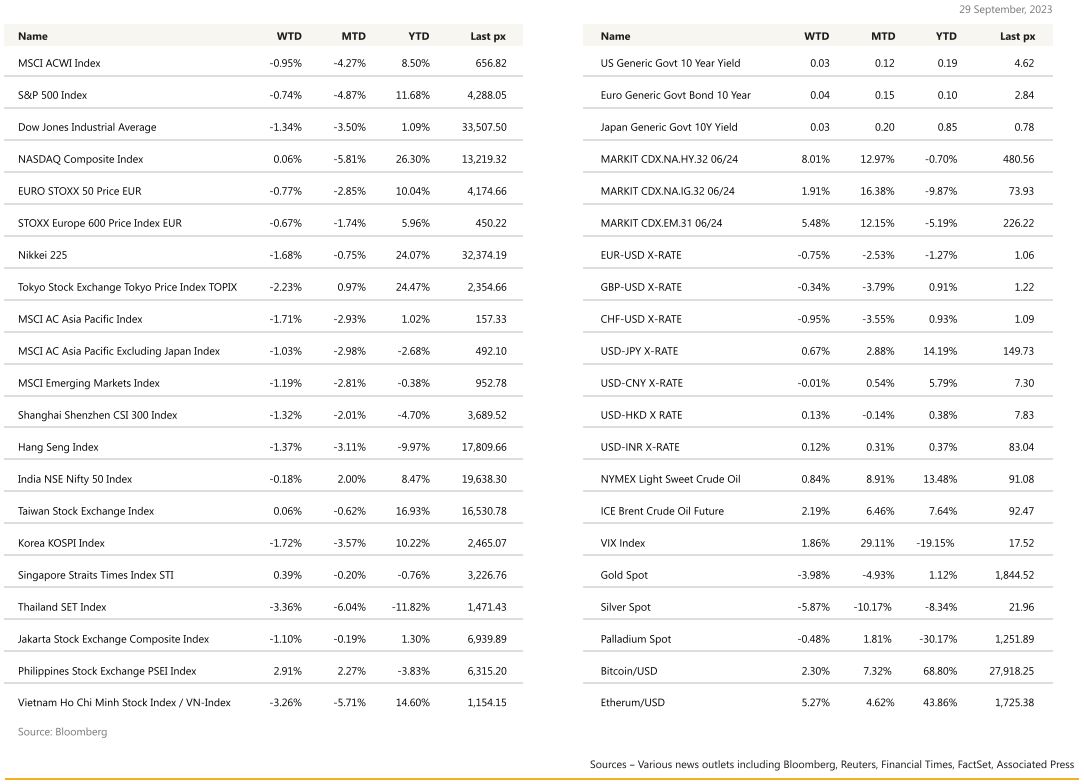

KEY MARKET MOVES

MACRO OVERVIEW

US

The Senate overwhelmingly passed bipartisan legislation Saturday (Washington) to avoid a disruptive US government shutdown, sending the bill to President Joe Biden for his expected signature just hours before a midnight deadline. The bill passed on an 88-9 vote.

US markets continued its down streak posting its biggest monthly drop of 2023, and the worst quarter since September 2022 on concerns about the Fed Reserve’s policy path in spite of signs of cooling in a key inflation gauge. The Fed’s preferred measure of underlying inflation pressures, the PCE Deflator, rose at the slowest monthly pace since late 2020, while consumer spending edged up. Core PCE Deflator MoM fell to 0.1% from 0.2% (below expectations) and YoY fell to 3.9% from 4.2% (as expected). Headline PCE which includes volatile food & energy prices came in as expected at 3.5% from a revised 3.4% last month. Personal spending and consumption held up although below expectations indicating the consumer continues to spend. US initial jobless claims showed some tightness in the labor market, with the number of new filings edging up slightly to 204,000 last week supporting consumption. However, with the recently expired student loan holiday and rising energy prices, we expect some of this discretionary spending to crimp. NY Fed’s Williams said the central bank is at or near its peak level of interest rates, though policymakers would keep them high for “some time” to bring inflation down to the central bank’s 2% goal – this was the kicker that sent shares lower in the latter half of Friday. Other Fedspeak included Fed Chicago’s President Austan Goolsbee who said policymakers shouldn’t place too much weight on the traditional economic idea that steep job losses are needed to quell inflation, which he said could lead officials to raising rates too high. Richmond’s Barkin said it’s too soon to know if another rate increase will be needed. Other data of interest was the U. of Mich. Inflation expectations which came in as expected at 3.2% and 2.8% for the 1 year and 5-10 year categories respectively, in spite of higher oil prices. The final GDP annualised release came in at 2.1% – no recession just yet perhaps.

On the S&P 500, Bloomberg Intelligence reported that without the Magnificent 7, the index largely trades at a discount to its pre-pandemic norm.

The autumn selloff, combined with positive EPS revisions, has left nine of 11 sectors below pre-2020 average multiples. Of the M7 shares, Amazon.com Inc. gained after news that it will invest as much as $4 billion in AI-startup Anthropic. Microsoft Corp. lost its only sell rating on Monday as Guggenheim upgraded its view on the software giant to neutral, citing a tailwind from generative artificial intelligence. GAI continues to power on….

In Mexico, Banxico kept its policy rate unchanged at 11.25% in a unanimous decision last Thursday. The hawkish pause emphasis remained on a resilient economy, a tight labor market, and mounting inflation measures that remain complex and that are now finding their way into core inflation. Similarly to other central banks, Banxico delivered a hawkish statement stating that it is warranted to keep the policy rate at this level for an extended period of time. The market is now pricing a shallower easing cycle next year, with the policy rate near 10% by EOY. While the probability of Banxico resuming hikes looks low, any further tightening from the Fed will add pressures to Mexican policymakers to keep rates unchanged for longer. This week will see the release of ISM data, factory orders and the key monthly employment data. Unemployment is expected at 3.7% from 3.8% with NFP to fall slightly to 165k from August’s 179k.

On oil, we recognise the expected lags in performance of oil companies in spite of crude’s ascend up 12.15% ytd. Opportunistically, we see potential for some upside for Chevron which is down 6.06% ytd, Conoco Phillips which is up 1.53% and Occidental up 3% ytd.

Europe

European M3 money supply, which is the broad measurement of all the money that’s available in an economy, has showed a decrease of 1.3% yoy to EUR 15.93 trillion in August 2023. Deposits placed by households decreased 0.2% and those placed by non-financial corporations went down 2.4%. Also, deposits placed by non-monetary financial corporations which exclude insurance corporations and pension funds shrank 18.9%.

In the Euro Area, EC sentiment survey went down 0.3pt to 93.3 in September which is a smaller decline as market expectations. Looking at the details, the EC sentiment decline was broad based across sectors. The consumer confidence indicator in the Euro

Area was confirmed at -17.8 in September 2023.

Prior to Euro area headline inflation data release, some of the countries published their preliminary information. In Germany, Europe’s largest economy, its headline CPI inflation was down 1.6% to 4.5%, below market expectations of 4.6%. It is the lowest level since Russia’s full-scale invasion of Ukraine.

The annual HICP which is the ECB’s preferred gauge of inflation, dropped sharply to 4.3% from 6.4% in the same period. On the other hand, in Spain, the CPI moved up 3.2% but was still beneath the 3.3% expected. This is largely the result of a base effect as Spanish electricity prices came down significantly in September 2022. The rise in crude oil prices is also listing consumer fuel prices.

Eurozone inflation has fallen to its lowest level for almost 2 years to a level of 4.3% comparing to a peak of 10.6% last year. After Friday’s inflation news, the yields on German 10-year debt which is the eurozone benchmark, fell 0.15% pts to 2.81%. With the inflation shows further slowing, that would strengthen the case that policy rates will no longer rise. With economic growth also looking weak, ECB is expected to remain on hold in the months ahead.

The key economic data releases this week are final PMI and unemployment rate releases across Europe. The key policy events this week are speeches by ECB, Riksbank and Norges Bank officials.

Asia

Asia closed the week down, MSCI Asia ex Japan took Monthly losses to -1.03%. Taking stock at month end, Thailand, Vietnam were the worst performers, down 6% and 5.7% respectively. India, Japan and Philippines were the only stock markets that closed September positive.

China’s industrial profits recovery accelerated in August. The National Bureau of Statistics (NBS) announced that total industrial profits (including all industrial companies with annual sales from principal business exceeding 20 million yuan) contracted 11.7% in Jan-Aug period.

China Evergrande and its units suspended trading on Thursday (28 Sep) no reason was given after reports of its billionaire founder put under police surveillance. Creditors have become increasingly concerned about the group’s prospects amid an uncertain debt revamp plan and liquidation risk. The world’s most indebted property developer with more than $300 billion in total liabilities. Group Chairman Hui Ka Yan is being investigated on suspicion of transferring assets offshore while the indebted property developer struggles to complete unfinished project.

China’s Ministry of Culture and Tourism estimates people will make more than 100M trips a day during the most popular Golden Week in history. The holiday, from 29-Sep to 6-Oct, will likely see 190M passengers travel by railway and 21M by air. Meanwhile traveling overseas is yet to rebound as outbound travel has only recovered to 60% of pre-Covid levels according to Trip.com with rising cost as a major factor. The holiday could be boost for travel, retail, and entertainment sectors despite macro headwinds. China is closed this week for Golden week and will resume trading Monday next week. Hong Kong is closed today, and will resume tomorrow.

Japan flash manufacturing PMI came in lower at 48.6 in September(vs 49.6 in the previous month).

This marks the fourth straight month in contraction. Output, new orders and exports all registered stronger declines. Finished goods inventories returned to growth as backlogs fell at a faster pace. Input prices strengthened while output price inflation remained steady. Services PMI logged a similar decline to 53.3 from prior 54.3, indicating the softest momentum since the start of the year. Output and new orders saw weaker growth while exports swung to contraction. Consumer prices excluding fresh food rose by a lower-than-expected 2.5%, decelerating from 2.8% in August.

This morning, we had BOJ’s quarterly Tankan report. The index of sentiment among Japan’s biggest manufacturers rose to 9 in September from 5 three months earlier. The sentiment for non-manufacturers soared to the highest in 32 years in the three months ended in September. The latest sentiment readings aren’t likely to shake BOJ Governor Kazuo Ueda’s resolve to hold policy settings steady for now, even if authorities upwardly revise official inflation forecasts — as widely expected by economists — when they gather later this month. The survey reflects expectations for steady inflation, with the three-year price growth projection for all industries steady at 2.2%.

Japan finance minister Suzuki repeated a warning on yen after currency neared 150-per handle traders eyeing as potential intervention trigger. The Yen is trading at 147.79 this morning.

In other Asian data points, Singapore’s core inflation continued to trend downwards in August, falling to 3.4 per cent year-onyear to reach its lowest in more than a year. Core inflation is expected to moderate further over the next few months as imported costs stay low compared to year-ago levels and the current tightness in the domestic labour market eases, said MTI and MAS.

For 2023 as a whole, headline inflation is expected to average 4.5% to 5.5%. The Bank of Thailand (BoT) unanimously voted to raise the policy rate by 25bps from 2.25% to 2.50%. Consensus was split between a pause and a hike. Australian retail sales growth slowed by more than expected. New Zealand business confidence turned positive for first time since mid-2021 but details were soft.

Later this week – Wednesday we have South Korea Production numbers and CPI reported on Thursday. On Friday, we expect the Reserve Bank of India to maintain a hawkish hold, with upside risks to inflation receding. Also on Friday, Japan’s wage data will also be worth watching, given its importance in the Bank of Japan’s assessment of the inflation outlook.

GEOPOLITICS

India will defer an import licence requirement for laptops and tablets, two government officials said, a policy U-turn after industry and the U.S. government complained about the move, which could hit Apple, Samsung, and others. The plan will be delayed by a year, after which the government will consider whether to implement a licensing regime or not. India’s electronics imports, including laptops, tablets and personal computers, stood at $19.7 billion in the April to June period, up 6.25% year-on-year.

James Rubin, a senior state department official, said China was using “coercive techniques and increasingly outright lies” to fulfil a “breathtaking ambition . . . to seek information dominance”.

China was also spreading surveillance and censorship technologies to governments around the world as part of technologically advanced “smart city” programmes, particularly in Asia, Africa and Latin America, the report said.

Brazilian President Luiz Inacio Lula da Silva said on Monday (Sep 25) that Vietnam has expressed interest in a trade deal with the Mercosur bloc of Brazil, Argentina, Paraguay and Uruguay, adding he will bring the topic up for discussion with those countries. Lula, who is currently chairing the group, said he wants to bring Mercosur members closer to Asian countries and highlighted there is room for trade with Vietnam to grow, as he welcomed Vietnamese Prime Minister Pham Minh Chinh in Brasilia. Canada, South Korea and Singapore are other countries in talks for trade deals with Mercosur.

France will withdraw all its troops from Niger over the next couple of months, following July’s military coup. The announcement follows similar French departures from Mali and Burkina Faso, in 2022 and 2023 respectively.

CREDIT/ TREASURIES

US Congress managed to pass a legislation to keep the government running for 45 days or until the 17th of November. The political circus in the US will therefore continue even if, for now, government shut down has been avoided. It is not surprising if rating agencies will, again, look to put on negative review the US Sovereign rating. To be noted and as part of the deal, congress blocked an additional aid package to Ukraine worth USD 6B.

While US politicians could find some kind of temporary relief to avoid shutting down their government, a little northwest of Washington, the United Auto Workers union decided to escalate their action and continue their strike which is now entering its third week.

Regarding US Macro data last week, the September Conference Board Consumer Confidence printed lower than expected. Present situation was better than August, but expectations were much lower than previous Month.

August durable goods orders printed higher than expected. Jobless claims and continuing claims again printed lower than expectations. August PCE deflator & Core PCE deflator printed in line with expectations at respectively +3.50 & +3.90% YoY. MoM was a touch lower at +0.40% & +0.10%. Finally, the University of Michigan Sentiment Index for September printed higher than expected, 1Year and 5-10years forward inflation rebounded by 0.10% to reach respectively 3.20% & 2.80%

The US Treasury curve continue to adjust to the new FED guidance that was communicated the previous week. 2years Treasury Yield dropped 5bps, 5years yield gained 5bps, 10years gained 14bps & 30years gained 17bps. The 2-10 spread is now trading at -47bps, which is its tightest level since the collapse of Silicon Valley Bank 7Months ago. But back in March the US Treasury curve flatten massively as the 2years yield collapsed, this time the flattening is due to long yield rebounding.

In term of performances US IG lost 80bps over the week, impacted by higher rates but IG credit spreads were unchanged. US HY lost 25bps, impacted by wider spreads, +35bps over the week, but supported by lower short-term rates. Leverage loans lost 30bps over the week, also penalized by wider spreads.

On a completely different note, delivery platforms in New York City must now pay $17.96 hourly wage to their couriers, the New York State Supreme Court ruled last Friday adding to further inflationary concerns. The pay rise, which was initially set to be implemented in July, before companies like Uber successfully lobbied for a restraining order. Based on the city estimates, delivery staff earn roughly $11 per hour under the current regulatory regime.

FX

DXY USD Index continued its upward trend into the end of Q3, rising 0.56% to 106. 174 post the hawkish FOMC last week, with US 10yr treasury yields at multi-decades high and VIX hitting its highest level since May at one point.

Risk off in risk assets supported USD (safe-haven currency). Data wise, US GDP confirmed at 2.1% qoq in third read for Q2, unchanged from second read. Core PCE deflator also confirmed at 3.7% qoq, in-line. US pending home sales missed by a large margin (-7.1%) from consensus (-1.0%), while Initial jobless claims came in stronger than expected.

EURUSD fell 0.75% to close the week at 1.0573, rebounding from oversold territory based on RSI indicator, at one point trading below 1.05 (key psychological level) intra-week. Data wise, solid miss on eurozone CPI, headline up 0.3%mom in September, consensus at 0.5%mom. Year-ended to 4.3%yoy, consensus 4.5%. Core also softer, at 4.5%yoy versus consensus at 4.8%yoy. Technically, there could be more downside on EURUSD with death cross forming.

GBPUSD fell 0.34% to close the week at 1.2199, rebounding from its low of 1.2111 intra-week, though still at oversold territory based on RSI indicator. Data wise, UK GDP confirmed at 0.2% qoq (in-line), and at 0.6% yoy (higher than expected).

USDJPY rose 0.67% to close the week at 149.37, due to US 10yr treasury yield hitting its highest level in multi decades, despite comments from MOF that FX moves are being watched with a high sense of urgency. The impact on USDJPY was minimal as well despite the unscheduled BoJ JGB purchase operations for the 5-10yr sector. Data wise, JP jobless rate held at 2.7% (vs. 2.6% expected), while core-core inflation slowed to +3.8% (vs. +3.9% expected). Immediate resistance level at 150, and despite the continued rise in USDJPY, it is not trading at overbought territory.

Oil & Commodity

Crude oil surges to fresh year-to-date highs as EIA data showed US crude stocks fell by 2.2mn barrels last week, compared to expectations for only a 320k barrel decline. This provided a fresh reminder of the oil market’s tightness, following oil production cutbacks by Saudi Arabia and Russia, while the US Strategic Petroleum Reserve still sits at historically low levels of inventory (351mn barrels). WTI and Brent closed the week at 90.79 and 95.31 respectively, rising 0.84% and 2.19%.

Gold tumbled 3.98%, breaking a few key support levels to close the week at 1848.63, due to the rapid rise on US treasury yields. Based on RSI indicator, gold is now trading at significant oversold territory. Immediate support at 1835, while immediate resistance level at 1850.

ECO

- Monday – NZ Building Permits, JP Tankan Index, AU Inflation, AU JP/SZ/EU/UK/US/CA Mfg PMI Sep Final, UK Nationwide Hse Px, SZ Retail Sales, EU Unemploy. Rate, US ISM Mfg/ ISM Prices Pai

- Tuesday – AU Building App./ RBA OCR, SZ CPI, US JOLT

- Wednesday – AU/JP/EU/UK/US Svc/Comps PMI Sep Final, NZ RBNZ OCR, EU Retail Sales, US MBA Mortg. App/ ADP Employ./ Factory Orders/ Durable Goods/ ISM Svc Inde

- Thursday – NZ Commodity Price, AU Trade Balance, UK Construction PMI, US Trade Balance/ Initial Jobless Claim

- Friday – CA Employ., US NFP/ Unemploy. Rate

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.