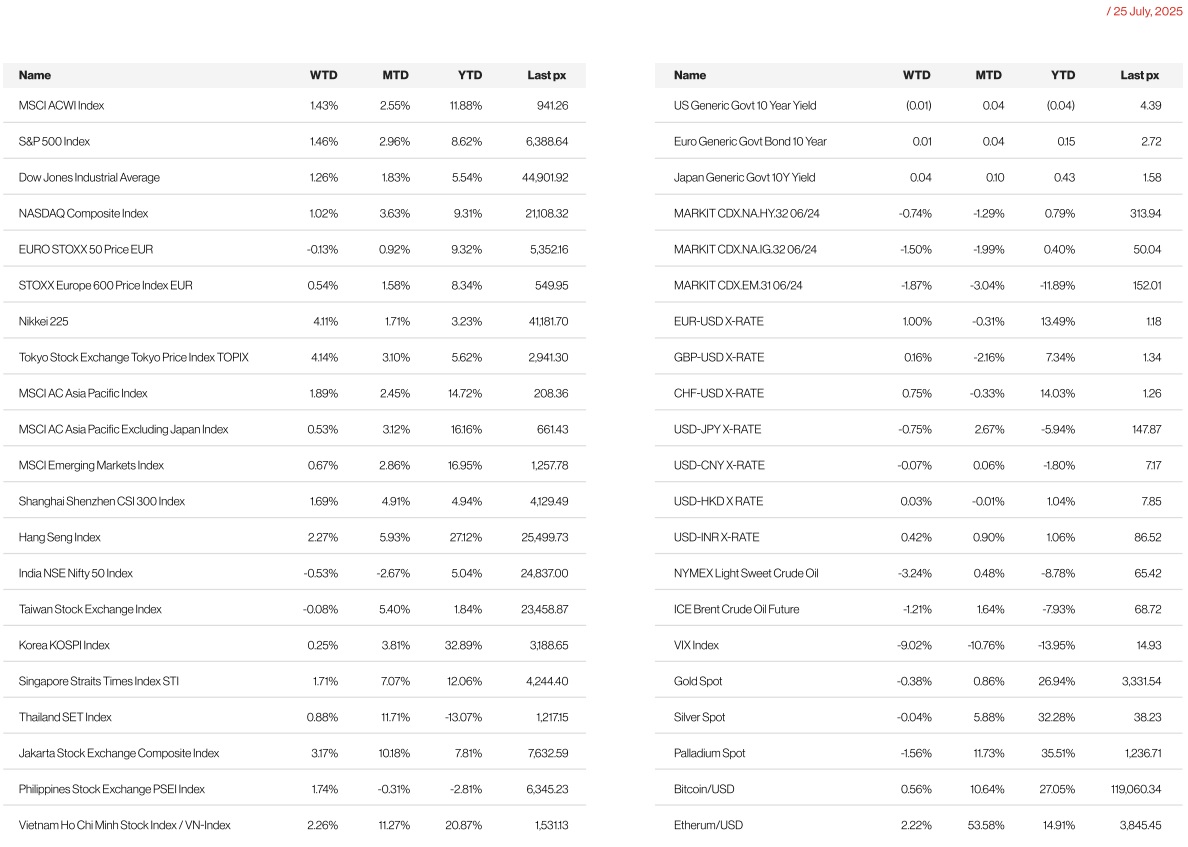

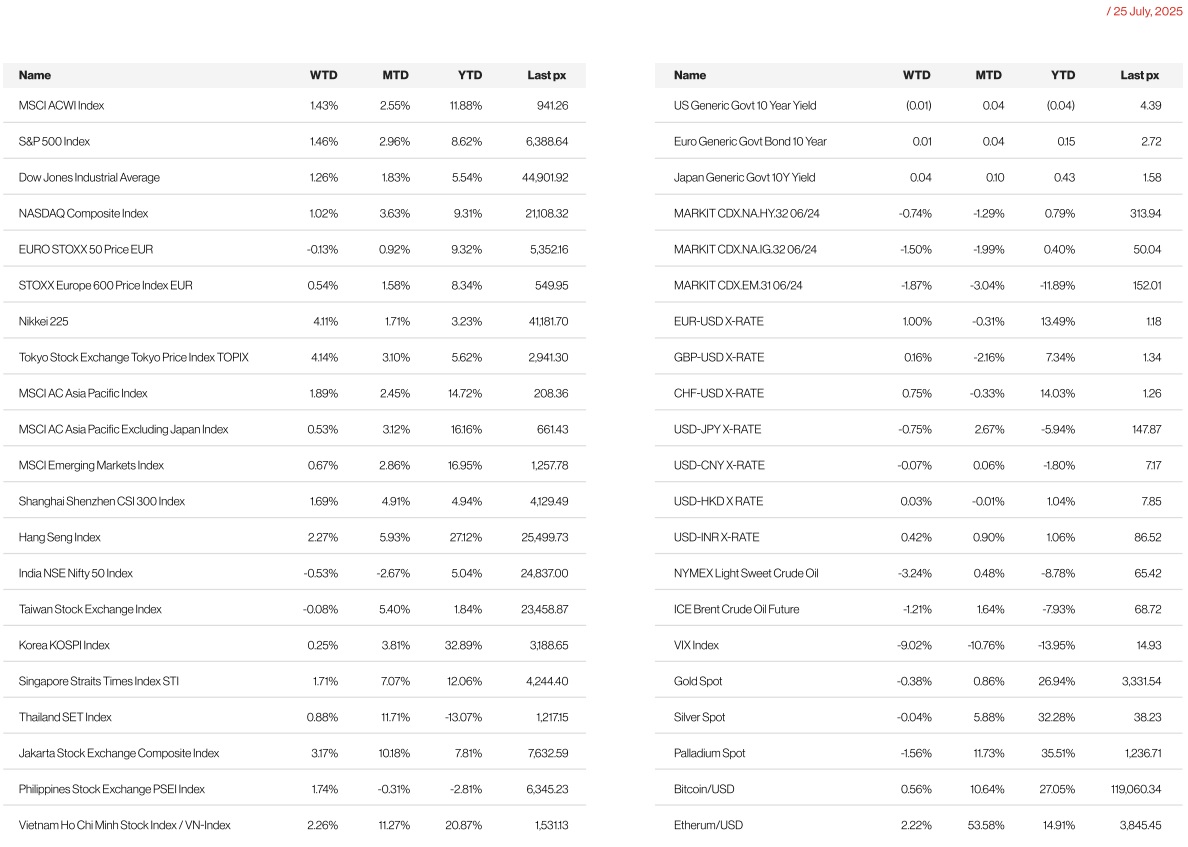

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

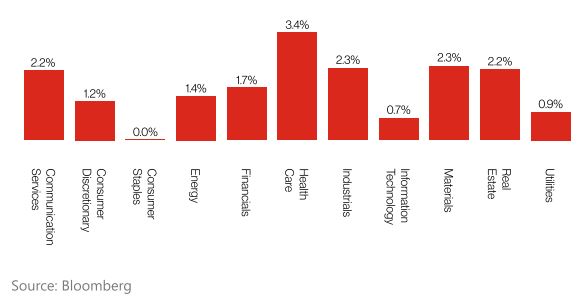

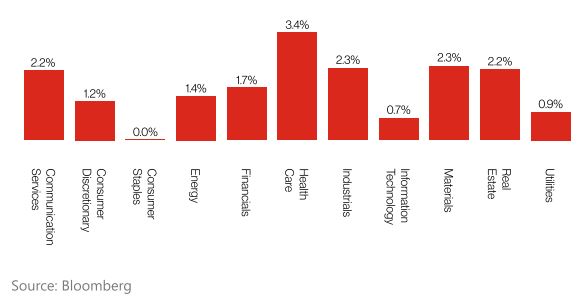

US markets soared to another record high as trade developments and favourable outlooks from chipmakers charged up stocks. The overall market structure remained calm with volatility falling (VIX last below 15) and caution prevailed ahead of this week’s Fed meeting and jobs data. Robust earnings certainly helped, with some 82% of companies on the index posting results that were above expectations. For the week we saw most sectors end in positive territory:

S&P 500 Weekly Sector Performance

Data for the week was light ~ initial jobless claims fell by more than expected, durable goods orders went the same way. In a week where there is a blackout for the Fed Reserve, Chair Powell underscored the need to for the banking system’s capital framework to work together effectively, and for banks to be well capitalised and to manage their risks well. Thursday will see the outcome of July’s Fed meeting where no change in rates is expected. It’s outcome is widely seen as a test of true independence from pressures of the White House to cut rates now.

We will also have key earnings from tech giants Apple, Amazon, Microsoft and Meta and Friday’s expiration of the August 1st tariff deadline. Officials, including Treasury Secretary Scott Bessent, emphasized that while trade talks may continue (notably with China’s separate August 12 deadline), the August 1 deadline for most partners is non-negotiable.

PCE comes out on Thursday with core expected at 0.3% m/m at a headline of 2.5% and unemployment.

Europe

European Commission President Ursula von der Leyen and U.S. President Donald Trump reached a tentative trade deal in Scotland on Sunday. Most EU exports to the U.S. will face a 15% tariff, lower than Trump’s previously imposed 20% and threatened 30% rates, and equal to Japan’s but more favorable than recent deals with Indonesia and the Philippines (both 19%). As part of the agreement, the EU will purchase $750 billion in U.S. energy over three years and increase its investment in the U.S. by over $600 billion. Both sides also agreed to eliminate tariffs on a range of goods, including aircraft, parts, chemicals, generic drugs, semiconductor equipment, and some agricultural products. It was a positive political development for President Donald Trump on a number of fronts. I think it s great we made a deal today instead of playing games, Trump said at the end of the meeting. I think it s the biggest deal ever made.

At its July 24 meeting, the European Central Bank (ECB) kept its policy rates unchanged, with the deposit facility rate remaining at 2.0%, as expected. The decision was unanimous and based on data broadly in line with June forecasts, which project inflation returning to target over the medium term and a resilient economic outlook. However, the ECB continued to describe the economic environment as more uncertain than usual and reaffirmed its data-dependent, meeting-by-meeting approach to future decisions. Despite the steady policy, ECB President Christine Lagarde struck a more hawkish tone than anticipated during her press conference. She signaled the ECB may be in a wait-and-watch mode, downplayed downside risks to growth, and dismissed concerns over projected inflation undershooting the target, suggesting the ECB may be less inclined to ease policy in the near term.

Recent euro area data offered mixed signals. The flash composite PMI rose slightly by 0.4 points to 51.0, with strength in the services sector (51.2) offsetting a small dip in manufacturing output (50.7). Money and credit figures showed a rebound in lending flows to both households and businesses, following recent weakness. On a y/y basis, household lending rose to 2.2% and corporate lending to 2.7%, both improving from May.

Looking ahead, key euro area releases this week include Q2 preliminary GDP, July consumer and business surveys, June unemployment, and the final July manufacturing PMIs.

In the UK, July’s flash composite PMI fell to 51.0 from 52.0 in June. The decline was primarily driven by weaker services activity, while manufacturing output improved to the neutral 50.0 mark, ending an eightmonth contraction streak. Consumer confidence dropped slightly (-1pt to 19), remaining subdued. Meanwhile, retail sales rebounded 0.9% m/m in June, though this was below expectations of a stronger recovery.

Asia

Markets in Asia closed the week higher, with MSCI Asia ex Japan up by 0.53%. Nikkei 225 took the lead, climbing 4.11% last week. This despite the Yen strengthening as traders unwind their hedge positions amidst PM Ishiba’s vow to stay on. There was also positive news with Donald Trump saying he reached a trade deal with Tokyo, which sets a 15% tariff on imports from Japan. The pact has called on Japan to “open their country” to US auto and agricultural imports.

The US and China are expected to extend their tariff truce by another three months, the South China Morning Post reported, citing unnamed sources. Analysts say the U.S.-China negotiations are far more complex than those with other Asian countries and will require more time. China’s grip on the global market for rare earth minerals and magnets, used in everything from military hardware to car windshield wiper motors, has proved to be an effective leverage point on U.S. industries. Chinese and Hong Kong markets are higher as of writing this morning.

South Korea’s gross domestic product improved a seasonally adjusted 0.6 percent on quarter in the second quarter of 2025, the Bank of Korea said on Thursday. Real gross domestic income increased by 1.3 percent compared to the first quarter. On an annualized basis, GDP improved 0.5 percent – exceeding forecasts for an increase of 0.4 percent following the flat reading in the three months prior.

Indonesia prepares to extend economic stimulus policies into Q3 2025, targeting 5.2 per cent annual growth with new package.

Tariff Updates:

- South Korea will prepare a trade package that is mutually agreeable with the United States ahead of minister-level meetings planned this week. The package will include shipbuilding cooperation, a sector of high interest to US Commerce Secretary Howard Lutnick, who discussed the matter with South Korea’s Industry Minister Kim Jungkwan. South Korea, facing 25 per cent tariffs, is rushing to reach a trade deal with Washington.

- Trump also announced US-Philippines trade deal which includes a military agreement, and tariff cuts from 20 per cent to 19 per cent. Philippines hopes to further lower tariff rate to around 15 per cent. The 19 per cent rate announced matches that of Indonesia and bests Vietnam’s slightly higher rate of 20 per cent. Singapore faces the lowest rate – 10 per cent – in Southeast Asia.

- Treasury Secretary Scott Bessent said he’ll meet his Chinese counterparts in Stockholm next week for more talks. He also said trade with China is in a «good place» but indicated next round of talks may involve Beijing’s purchases of sanctioned Russian and Iranian crude.

- Indian trade negotiators have returned to New Delhi after five rounds of discussions. Government sources said hopes were fading for an interim deal before the Aug 1 deadline as talks stalled over hard lines drawn by both sides.

- Malaysia seeking to lower its US tariff to 20% from 25% however, citing people familiar with matter, said Kuala Lumpur resisting Washington’s demands to extend tax breaks on US-made EVs.

- Taiwan’s economic minister Kuo said he was optimistic of securing a rate lower than 25% handed to South Korea and Japan, forced to quash online speculation Washington had decided on 32% rate for island.

GeoPolitics

Israel – Syria – US: US President Donald Trump was «caught off guard» by Israeli strikes in Syria last week. Israel had launched strikes on the capital Damascus and the southern Druze-majority city of Sweida, saying it aimed to put pressure on the Syrian government to withdraw its troops from the region amid ongoing clashes there. Israel and Syria on Friday entered a US-brokered ceasefire. Also on Friday, PM Netanyahu called Pope Leo to express regret at the strike on the Catholic church in Gaza, blaming a «stray missile».

EU – Asia – US: The EU must strengthen its security and defense partnerships with Asian countries despite pressure from the Trump administration to focus only on Europe’s domestic security, Brussels’ chief diplomat has said. The Pentagon has told European nations it believes their armies should take more responsibility for security in their own region to free up the US military to focus more on China and the Indo-Pacific, a message championed by Elbridge Colby, US under-secretary of defense for policy. The EU has formal security and defense partnerships with Australia, Japan and South Korea, and in 2020 signed a broad “strategic partnership” with the Association of Southeast Asian Nations regional group.

China – US: China’s rare earths exports to the US increased 660% in June from May reflecting their 90-day truce, though volumes are still below what China was exporting before imposing partial bans in April. In the immediate term (July–August 2025), market watchers anticipate a modest improvement in supply. In response to steep tariffs from the US administration, the Chinese government had imposed export restrictions on seven rare earth elements and magnets earlier this year. The move threatened to derail global supply chains, with more than 70% of rare earth production based in China. More than 90% of the processing also takes place in China. Commerce Ministry emphasized that it has not scrapped its export permit requirement. Rather, it simply agreed to process applications “in accordance with the law”.

Thailand – Cambodia: Tensions between both countries reignited in May following the killing of a Cambodian soldier during a brief exchange of gunfire, which escalated into a full-blown diplomatic crisis and now has triggered armed clashes. Thailand’s acting Prime Minister Phumtham Wechayachai warned Friday (Jul 25) that cross-border clashes with Cambodia that have uprooted more than 130,000 people «could develop into war». More than 138,000 people have been evacuated from Thailand’s border regions, its health ministry said, reporting 15 fatalities – 14 civilians and a soldier – with a further 46 wounded, including 15 troops as of reporting on Friday. Thailand and Cambodia’s leaders are due to meet for peace talks on today, July 28, as a festering territorial dispute along their shared frontier dragged into a fifth day of open combat. In an effort initiated by US President Donald Trump, Thailand’s acting Prime Minister Phumtham Wechayachai and Cambodia’s Prime Minister Hun Manet will meet at 3pm in Kuala Lumpur.

France – Palestine: France intends to recognise a Palestinian state in September at the United Nations General Assembly, President Emmanuel Macron said on Thursday in hopes of bringing peace to the region, but the plan drew angry rebukes from Israel and the United States. Macron, who unveiled the decision on X, published a letter sent to Palestinian Authority President Mahmoud Abbas confirming France’s intention to press ahead with Palestinian recognition and work to convincing other partners to follow suit.

Israel – Palestine: Israel said it resumed aid airdrops to Gaza on Saturday and was taking several other steps to ease the humanitarian crisis in the Palestinian enclave, amid mounting international pressure and warnings from relief agencies of starvation spreading there. The announcement came after indirect ceasefire talks in Doha between Israel and the Palestinian militant group Hamas were broken off with no deal in sight. The Israeli military said in a statement that the airdrops would be conducted in coordination with international aid organisations and would include seven pallets of aid containing flour, sugar, and canned food. Palestinian sources confirmed that aid has begun dropping in northern Gaza.

Credit/Treasuries

10y UST yield fell about 3bps for the week to 4.38% with the 2s10s curve flattening 8bps. Trump’s comments that firing Powell wasn’t “necessary” eased some concerns around the Fed’s independence and stalled the momentum of curve steepening. Decent demand at the 20- year auction during the week also signalled underlying demand for longend with yields around 5%.

FX

DXY USD Index fell 0.85% to 97.645. Safe-haven currencies including USD weaken due to positive risk sentiment on trade fronts. US and Japan reached an agreement that features a 15% tariff, below the 25% rate threatened by President Trump. Over the weekend, EU reached tariff deal with US, which will see the EU face 15% tariffs on most of its exports. With that, Fed easing expectations fell with market pricing in less than 45 bp of rate cuts for this year, the lowest since February. We have the FOMC meeting on 30th July, where the Fed is expected to hold rates.

European Currencies rose against USD with EUR (+1% to 1.1742), GBP (+0.16% to 1.3438) and CHF (+0.74% to 0.7954). ECB kept its policy rate unchanged at 2% as expected, with ECB President Lagarde signalling patience on further rate cuts. In addition, continued speculative reports of progress towards a potential US-EU trade agreement last week supported EUR. GBP underperformed on softer-than-expected retail sales data. EURGBP rose 0.82% to close the week at 0.8739, surpassing the high last seen in April, as Eurozone PMI beats with UK PMI softer.

Antipodean Currencies rose against USD with AUD (+0.88% to 0.6566) and NZD (+0.92% to 0.6017), driven by positive risk sentiment. In AU, composite PMI increased to 53.6 in July, up from 51.6 previously, reaching its highest level since April 2022 and marking the tenth consecutive month of expansion. Furthermore, the services PMI rose to 53.8 in July from the previous reading of 51.8, achieving its fastest growth rate in 16 months. Meanwhile, the manufacturing PMI registered at 51.6 in July compared to 50.6 previously. New orders for manufactured goods have rebounded, resulting in the strongest overall growth in new business in over three years. In NZ, Downside surprise in New Zealand CPI at 2.7% y/y (C: 2.8%), although inflation remains slightly above the RBNZ’s 2.6% expectation. Cuts are priced in across the RBNZ policy path following the release with the market implied probability of an August rate cut rising above 80% (P: 66%).

USDJPY fell 0.75% to 147.69. In Japan, the ruling coalition loses its majority in the Japan upper house election as anticipated, but Prime Minister Ishiba states he would not resign, which is a positive for JPY. In addition, reduced trade uncertainty renews expectations for a potential BoJ rate hike in 2025. S&P Global Japan services PMI rose to 53.5 in July from 51.7 in June, driven by growth in new business. Conversely, the manufacturing PMI fell to 48.8 in July from June’s final reading of 50.1, that had marked the first time in 13 months that the index had exceeded 50.0. July Tokyo core CPI came in below consensus (2.9 y/y; C: 3.0%).

Oil & Commodity

WTI crude and Brent crude oil futures fell 3.24% and 1.21% to close the week at 65.16 and 68.44 despite the positive risk sentiment from US-JP trade agreement. China’s fiscal revenue dropped 0.3% year-on-year in H1 2025, raising concerns about demand from the world’s second-largest oil consumer. The U.S. authorized Chevron to resume operations in Venezuela, potentially adding 200,000+ barrels/day to global supply, raising supply expectations.

Gold fell 0.38% to 3337.30 driven by positive risk sentiment despite USD weakness. Support level at 3260 and 3180, while resistance level at 3440.

Economic News This Week

- Monday – US Dallas Fed Mfg Act.

- Tuesday – EU ECB CPI Exp., US Wholesale Inv/JOLTS/Cons. Confid.

- Wednesday – AU CPI, EU GDP, US MBA Mortg. App./ADP/ GDP/Core PCE/Pending Home Sales/FOMC Rate Decision, CA BOC Rate Decision

- Thursday – JP Retail Sales/Indust. Pdtn/BoJ Rate Decision, AU Retail Sales, CH PMI, EU Unemploy. Rate, CA GDP, US Core PCE/Initial Jobless Claims/Personal Income/Personal Spending/MNI Chicago PM

- Friday – NZ Building Permits, JP Jobless Rate, AU PPI, JP/ CH/SW/NO/EU/UK/US Mfg PMI July Final, UK Nationwide House, EU CPI, US Nfp/Unemploy. Rate/ISM Mfg/UMich Sentiment

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.