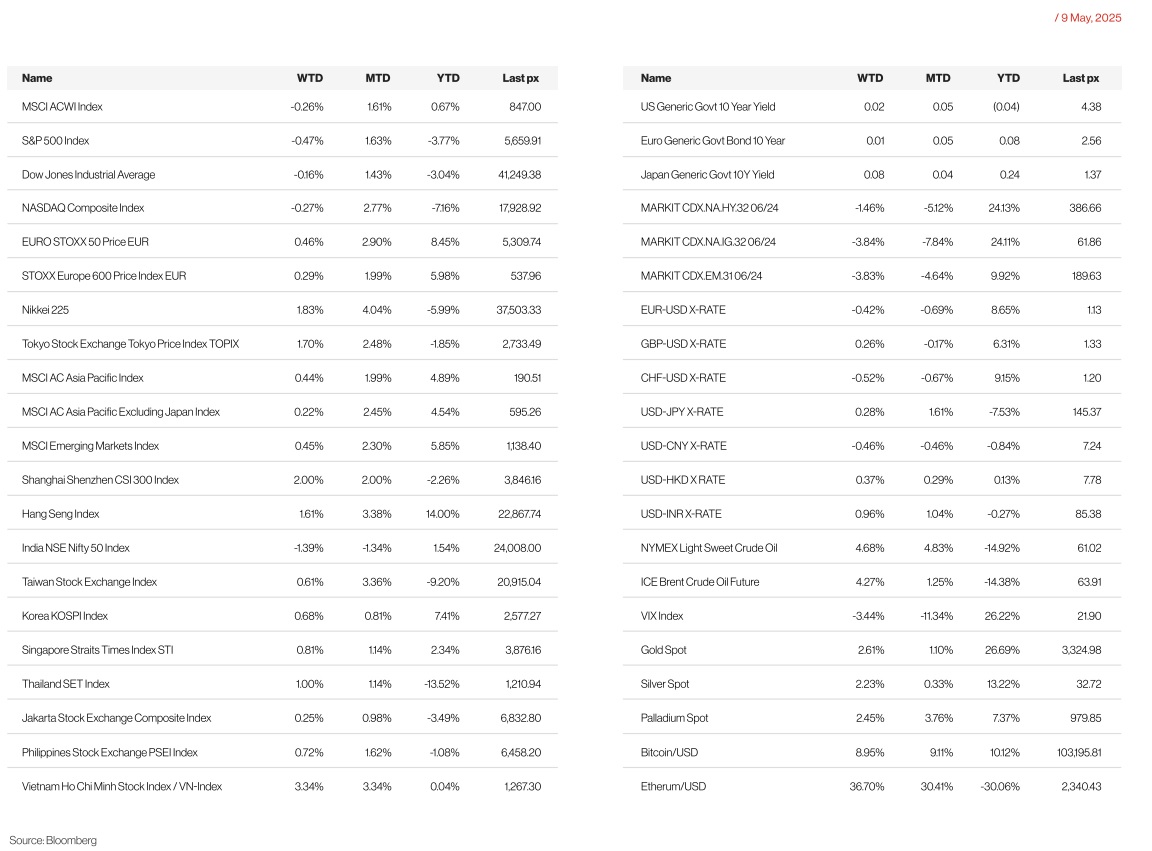

KEY MARKET MOVES

Source: Bloomberg

MACRO OVERVIEW

US

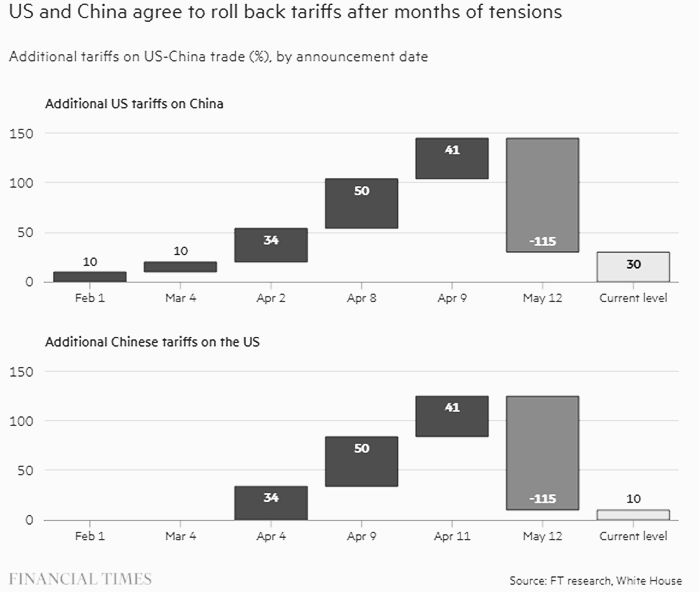

Such was the outcome from the meeting between the US and China over the weekend in Switzerland, where the US and China will temporarily lower tariffs on each other’s products, with the US reducing its levies from 145% to 30% and China reducing its duties from 125% to 10%. 90-days to work out a broader agreement, with the possibility of extending the truce further if there is good faith effort and constructive dialogue. Whilst details are scarce, this is seen as a significant de-escalation of trade tensions between the 2 countries. The US is pressing for China to open to more US goods with the aim of pulling a bilateral trade deficit into balance. The dollar hit a one-month high versus the euro and yen, and havens like gold and US Treasuries are dropping. Tech stocks got a boost from news that the Trump administration planned to rescind Biden-era AI chip curbs as part of a broader effort to revise semiconductor trade restrictions. Not all sectors though, are celebrating as drug stocks are down, trading on news that Trump plans to mandate a cut in US prescription drug costs to bring them in line with other countries. The VIX however has fallen below 20 whilst 10-year UST yield spiked higher to 4.45%.

Markets were also buoyed by cooling geopolitical tensions as Russia’s Putin offered to hold direct talks with Ukraine, and India and Pakistan agreed to an immediate ceasefire, which was mediated by the US. Senior European officials are in talks with the Trump administration to finalize an agreement on a 30-day ceasefire in Ukraine that would impose new sanctions on Russia if President Vladimir Putin doesn’t budge, according to people familiar with the matter.

Earlier in the week the Fed kept rates unchanged as expected. Having held pat on rates (at 4.25%–4.50%) since December 2024 the central bank noted “the risks of higher unemployment and higher inflation have risen.” The FOMC statement indicated that economic activity is “solid” with inflation somewhat elevated. Moreover, the risks of “higher unemployment and higher inflation” (stagflation risks) were judged to have risen. The upshot is that there is insufficient reason for the Fed to move, and a period of pause (until data weakens) remains the best course of action.

During his presser, Fed Chair Powell reiterated that he would not be rushed into lowering rates until there is greater clarity regarding the direction of trade policy. “There’s so much that we don’t know. We’re in a good position to wait and see, we don’t have to be in a hurry,” Powell stated. The US and UK agreed on a trade deal Thursday which fuelled expectations that the deal may be a blueprint for other countries.

Data out during the week showed the ISM services sector expanded more quickly than expected in April. While the print came in above forecast and consensus expectations, the dominant theme is still uncertainty. Both the S&P Global US Services & Composite PMI underwhelmed, falling in April below consensus. April FRBNY 1-Year inflation forecast printed at 3.63% Vs 3.58% expected. Some economists believe that the New York Fed model might be more accurate than the University of Michigan (recent methodology changes impacting measure), regarding forward inflation calculation accuracy.

US CPI, PPI and retail sales for April will be the data highlights this week, and both take on added significance as they could show some early impacts from tariffs. Michigan consumer sentiment is also due. Chair Powell speaks on Thursday. Consensus is a 0.3% MoM Core CPI from 0.1% and headline YoY to come in at 2.4%, unchanged. We’ll also have the U of Mich. sentiment and inflation expectations on Friday, that the Fed looks at.

Separately, President Trump will begin his Middle East trip, visiting Saudi Arabia, Qatar and the UAE to discuss planned investment in the US.

Europe

The European stock market ended the week with the Eurostoxx 50 closed higher at 0.46% and at 8,465 YTD.

The European Commission has released a draft list of US goods—covering ~30% of EU imports—that may face retaliatory tariffs, signaling a more limited response than US measures (~70% of EU exports), likely to avoid broader economic disruption.

Manufacturing activity picked up in late Q1, especially in Germany, though overall euro area growth remains weak. March industrial production rose 3.1% m/m—the strongest since August 2024—while Spain posted solid gains, and France and Italy saw weaker results. April PMIs were revised slightly up, with modest improvements in Germany and France.

Meanwhile, retail sales fell 0.1% m/m in March, reflecting soft consumer demand.

ECB Vice-President de Guindos stated that factors like a stronger euro and falling energy prices could help bring inflation down, supporting potential rate cuts. He ruled out a recession, maintaining expectations for low but positive growth.

On 8 May, the EU launched a consultation on potential tariffs on $95 bn of U.S. exports, including cars and aircraft, with input open until 10 June. This follows a suspension of earlier EU measures targeting U.S. steel and aluminum, and a planned WTO complaint.

The EU Council will review the SAFE proposal on 13 May, which would allow up to €150 bn in EU bonds to finance defense spending.

In the UK, the Bank of England’s Monetary Policy Committee (MPC) reduced the Bank Rate by 25 basis points to 4.25% during its May meeting. The vote was notably divided: two members (Dhingra and Taylor) favoured a 50 bp cut, while two others (Mann and Chief Economist Pill) preferred to hold rates steady. The May Monetary Policy Report downgraded the UK’s growth outlook beyond Q1 2025, but the overall guidance continued to reflect a cautious and gradual approach to policy easing. Barclays projects another 25 bp rate cut in June, with two more to follow, potentially bringing the Bank Rate down to 3.5 % by September.

Also on 8 May, the U.S. announced a preliminary trade agreement with the UK and President Donald Trump pitched his trade framework with the UK as a historic achievement, and the first step in his revolutionary effort to overhaul the global economy. But as the president began revealing specifics of the deal, it became clear it fell short of the “full and comprehensive” agreement he had promised, or the US-UK free-trade pact he pursued during his first term. “From the point of view of markets generally, as well as those who are concerned about the US economy, this is a nothingburger,” said Tim Meyer, an international trade law professor at Duke University School of Law. “There’s nothing real to see here. Obviously, this is a framework, this is not actually an agreement.” “A full-blown trade agreement, which will likely take months, if not years, to be finalized, and it will still be some time before the finer details are ironed out.” The US and UK also gave conflicting information about key elements of the agreement, which went to final-hour negotiations. The British government released a statement saying US tariffs on steel and aluminum from the UK will go to zero, while the White House put out its own description less than an hour later saying they “will negotiate an alternative arrangement” to the metals duties. Trump kept the 10 % baseline tariff on the UK — the same rate he applied in his April 2 rollout, a warning shot to countries hoping to get below that figure. Investors hoping for a more substantial détente may also be disappointed.

This week’s attention will turn to the final inflation data (HICP) for April in Germany, Spain, France, and Italy, which are due Wednesday through Friday. Economic activity updates will include the euro area’s second estimate for Q1 GDP, employment growth figures, March industrial production, and trade balance data — all scheduled for Thursday and Friday. In the UK, GDP data for both March and Q1 will be released on Thursday.

Asia

Over the weekend, US President Donald Trump announced a de-escalation of the trade war with China, saying China agreed to remove non-tariff barriers to US imports. The agreement will temporarily lower duties to give both countries more time to negotiate, with the US reducing its levies on most Chinese imports from 145 % to 30 %, and China dropping its duties on US goods from 125 % to 10 %. Trump warned that tariffs could still increase if talks fail to secure an agreement within 90 days, but said the US would not raise tariffs back to 145 %. Data last week showed China’s overall exports surge 8.1 % in April even though China’s outbound shipments to the US plunged over 21 %.

US and China agree to roll back tariffs after months of tensions

India has proposed zero tariffs on steel, auto parts, and pharmaceuticals as it works to strike an early tariff deal with the US. India offers to narrow tariff gap with US to under 4 %. India ready to give preferential access to 90 % of US goods and has asked exemption from all “current, potential” tariff hikes. Also, India wants US to align with allies on critical issues.

UK and India strike a trade deal. The deal will see India gradually lower import taxes, with most goods traded becoming “fully tariff-free within a decade.” The U.K. government said the agreement is expected to increase bilateral trade by £25.5 billion ($34 billion). Trade between the two nations stood at £42.6 billion in 2024, up 8.3 % from the previous year.

Trump administration offering to only cut 14 % tariff on Japan, has refused full exemption from reciprocal tariffs. Japan also said it has no plans to sell its $1 trillion-plus holdings of U.S. Treasuries according to its finance minister, clarifying earlier remarks that the bond holdings could be used as bargaining chip.

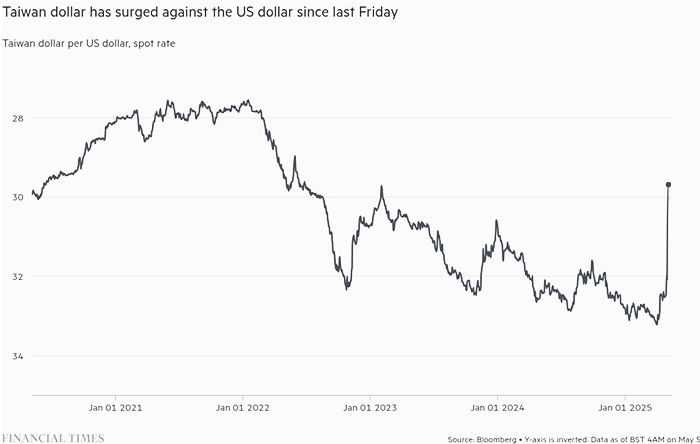

Taiwan’s government said on Monday (May 5) that tariff talks with the United States last week did not discuss the exchange rate and Taiwan’s central bank has not taken part in the discussions. While Trump is likely to press Taiwan for a further appreciation of its currency, there is no consensus in the foreign exchange market on how high it might rise against the U.S. dollar, given Trump’s unpredictability, the analyst said. Taiwan has a huge pile of overseas assets amounting to $1.7 trn, much of it in the form of U.S. bonds – including Treasuries and corporate debt – held by the central bank. The U.S. Treasury Department uses three criteria to assess potential currency manipulation: a bilateral trade surplus of at least $15 billion with the US; a material current account surplus of at least 3 percent of GDP; and evidence of persistent, one-sided foreign exchange intervention. Taiwan currently meets the first two criteria.

Other Data from Asia:

Taiwan’s headline CPI inflation moderated to 2.0% oya in April. Taiwan’s April exports beat expectations again, rising 29.9% oya.

China CPI, released Saturday, was in line with consensus at –0.1% oya in April, extending the period of negative inflation to three consecutive months. Thailand’s headline inflation again undershot expectations, dropping from 0.8% oya in March to –0.2% oya in April.

GeoPolitics

Israel – Palestine: Israel may seize all of Gaza in new offensive, though they may not be launched until Trump wraps up his visit to the region. Israel’s security cabinet approved the expansion of military operations in Gaza including the “conquest” of the Palestinian territory. The plan includes the holding of territories in the besieged Gaza Strip and comes alongside Israel’s promotion of Gaza’s residents to leave. Alongside the plan to expand military operations, Prime Minister Netanyahu “continues to promote” a proposal by US President Donald Trump for the voluntary departure of Gazans to neighboring countries, the sources said. Israel’s military will mobilize tens of thousands of reservists in the coming days.

Israel – Yemen: Israeli warplanes on Monday struck targets in Yemen, a day after a ballistic missile fired by Houthi rebels exploded near Israel’s main international airport. The Yemeni rebels have fired at least 17 ballistic missiles at Israel since March, after Israeli Prime Minister Benjamin Netanyahu abandoned a ceasefire with Hamas and restarted Israel’s offensive in Gaza. The Houthis, who control much of northern Yemen, have said they are acting in solidarity with the Palestinians.

The Israel Defense Forces said the planes targeted the Hodeida port complex on the Red Sea, as well as a nearby concrete factory, which the IDF claimed were important sources of income for the Iran-backed Yemeni militant group and gateways for the transfer of Iranian weapons.

Israeli warplanes attacked Yemen’s Sana’a airport. The Israeli military said it had “fully disabled” the international airport, hitting the runway, aircraft and other infrastructure about two hours after issuing a warning to civilians to clear the area.

Middle East – US: Donald Trump will touch down in Saudi Arabia this week for the first official foreign tour since he returned to the White House, with high expectations of securing a raft of multibillion-dollar deals. Prince Mohammed, who was edging closer to a three-way deal with the US to normalize ties with Israel before the war erupted, has described his conduct in Gaza as “genocide” and insists Riyadh will not have diplomatic ties with Israel until a Palestinian state is established. Trump will also find Gulf leaders pushing the US to create a wall in Iran over the Islamic republic’s expansive nuclear programme.

India – Pakistan: India and Pakistan agreed to a ceasefire on Saturday, calling a halt to a four-day conflict that India painted as an essential showdown with a country it accuses of supporting cross-border terrorism. Both countries are portraying themselves as the winners of the military exchanges. Pakistan’s Prime Minister Shehbaz Sharif said in an address to the nation on Sunday that his country had won a “historic victory” against India. India’s Prime Minister Narendra Modi has said on a televised address on Monday that his country has proved its military “superiority” in clashes with Pakistan and that his government won’t hesitate to use force to neutralize terrorist camps in Pakistan, calling it a “new normal” in relations with its neighbour.

Credit/Treasuries

The US Treasury curve slightly bear-flattened last week with the 2 years yield higher by 10 bps, 5 years increased by 11 bps, 10 years yield gained 9 bps and the long bond yield gained 5 bps. US IG 5 years credit spreads tightened by 3.4 bps, US HY 5 years credit spreads tightened by 10 bps.

Investors are underestimating Donald Trump’s resolve to restore the steep tariffs that upended markets last month, bond giant PIMCO has warned, as its investment chief has cited recession risks were now the highest in years. Trump imposed “reciprocal” levies on many major trading partners at his “liberation day” event on April 2, a move that sent US equities and some corporate debt reeling. The president’s decision a week later to pause the levies on most trading partners for 90 days calmed markets, with the S&P 500 share index reversing the plunge triggered by the announcement. However, on the sidelines of the Milken Institute Global Conference in Beverly Hills, PIMCO said investors were mistaken to think Trump’s levies would be completely withdrawn or less forceful than previously announced. Dan Ivascyn, chief investment officer at Pimco warned that Trump’s policies had increased uncertainty over the outlook for the world’s biggest economy and could increase inflation and unemployment. He added that Pimco still favoured “high-quality sectors like mortgages” given the “household balance sheet is very strong”. At the same time, he said Pimco had made small increases to its US government debt exposure over the previous two months, focusing on shorter-dated maturities.

FX

DXY USD Index rebounded above 101.50 after the US and China announced a sharp drop in tariff rates for at least 90 days (reciprocal) tariffs for both countries now at 10%; for China goods into US: an additional 20% tariff remains related to fentanyl and other measures). DXY USD Index is trading at 101.64 at the point of writing. Last week, the DXY Index keeps rates unchanged at 4.50% as widely expected, highlighting that one of the “risks of higher unemployment and higher inflation have risen”, but reiterating that policy is “well-positioned” to wait for further clarity. On US macro, April ISM Services index (better-than-expected) rose to 51.6 (C: 50.2; P: 50.8) and remained in expansionary territory. That said, Prices Paid index increased and reached the highest level since January 2023. We have the key macro data – US CPI today and US Retail Sales tomorrow.

Safe-Haven Currencies underperformed with USDJPY and USDCHF gaining more than 2% since last week. USDJPY is trading close to 148, while USDCHF is trading close to 0.884 at the point of writing. In Switzerland, Headline CPI slowed to 0.0% (P: 0.2%; C: 0.3%) while Core CPI slowed to 0.6% (P: 0.8%; C: 0.9%) in April. CHF is little changed amid comments from SNB Chairman Schlegel that the Swiss franc has appreciated a lot and the SNB stands ready to intervene, if necessary. In Japan, wages missed “labor cash earnings up 2.1% y/y in March, consensus at 2.5% y/y. Second month in a row where base pay has been at the 2% y/y mark, a material shift down from the 2.7–3.0% range over the prior 6-months.

European currencies fell against USD with EURUSD trading close to 1.11 and GBPUSD close to 1.318 driven by broad USD strength. EURGBP fell to 0.842 as US and UK reached a trade deal. Even though the 10% reciprocal tariff rate remains in place, but the deal removed tariffs on UK steel and aluminium. In Eurozone, EU leaders reiterated their planned unity when negotiating any trade deals with the US.

USDTWD touched a near three year low of 29.458 last Monday. TWD appreciation was influenced, in part, by speculation surrounding a possible US trade deal that could necessitate Taiwan strengthening its currency. However, both Taiwans central bank and the Cabinet s Office of Trade Negotiations have denied that the US has requested currency appreciation or that the issue is even part of trade talks. USDTWD has since recovered more than 3% from its low, still short of 7% to pre liberation day level.

Oil & Commodity

WTI crude and Brent crude oil futures reversed its downward trend, gaining significantly since 5th May where both futures touched a year to date lows after OPEC+ announces that it will unwind its production cuts at an accelerated rate. Since then, WTI crude rose more than 13% from a low of 56 to a high of 63.61 yesterday, while Brent crude rose more than 11% from a low of 59 to a high of 66.40. Apart from positive tariff development, oil prices were supported by EIA data showing consecutive weekly declines in US crude inventories for the first time since January.

Gold pared its recent strength and fell close to the key support level of 3200 following the positive trade developments. It is trading at 3225 at the point of writing. In addition, the fall in gold price was further supported by de-escalations in geopolitical tensions over the weekend, where India and Pakistan have agreed to a full and immediate ceasefire, mediated by the US. A break below 3200 suggest a change in trend.

Economic News This Week

- Tuesday – AU Cons. Confid./Biz Confid., UK Unemploy., EU Zew, US Small Biz Optim./CPI

- Wednesday – JP PPI, SW CPI, US Mortg. App., CA Building Permit

- Thursday – NZ Food Prices, AU Unemploy., UK GDP/Indust. Pdtn/Mfg Pdtn/Trade Balance, EU GDP/Indust. Pdtn, US Empire Mfg/Retail Sales/PPI/Initial Jobless Claims/Indust. Pdtn

- Friday – NZ Biz Mfg, JP GDP/Indust. Pdtn, US Housing Starts/UMich

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2025 Bordier Group and/or its affiliates.