- Singapore

A brief recap of the market’s past week, by Bordier Singapore

Our website uses cookies to improve the overall user experience. By continuing, you are agreeing to our Data Protection, to our Disclaimer and use of cookies on the site.

|

You are using an insecure Internet browser Navigateur internet non sécurisé |

||

|

We have noticed that you are using Internet Explorer which is an outdated and insecure Internet browser. Please use one of the browsers below for a safe and optimal experience on our website.

Nous avons remarqué que vous utilisez Internet Explorer, qui est un navigateur internet obsolète et non sécurisé. Nous vous recommandons d’utiliser à la place l’un des navigateurs ci-dessous pour une expérience sûre et optimale sur notre site.

|

||

| Edge | Firefox | Chrome |

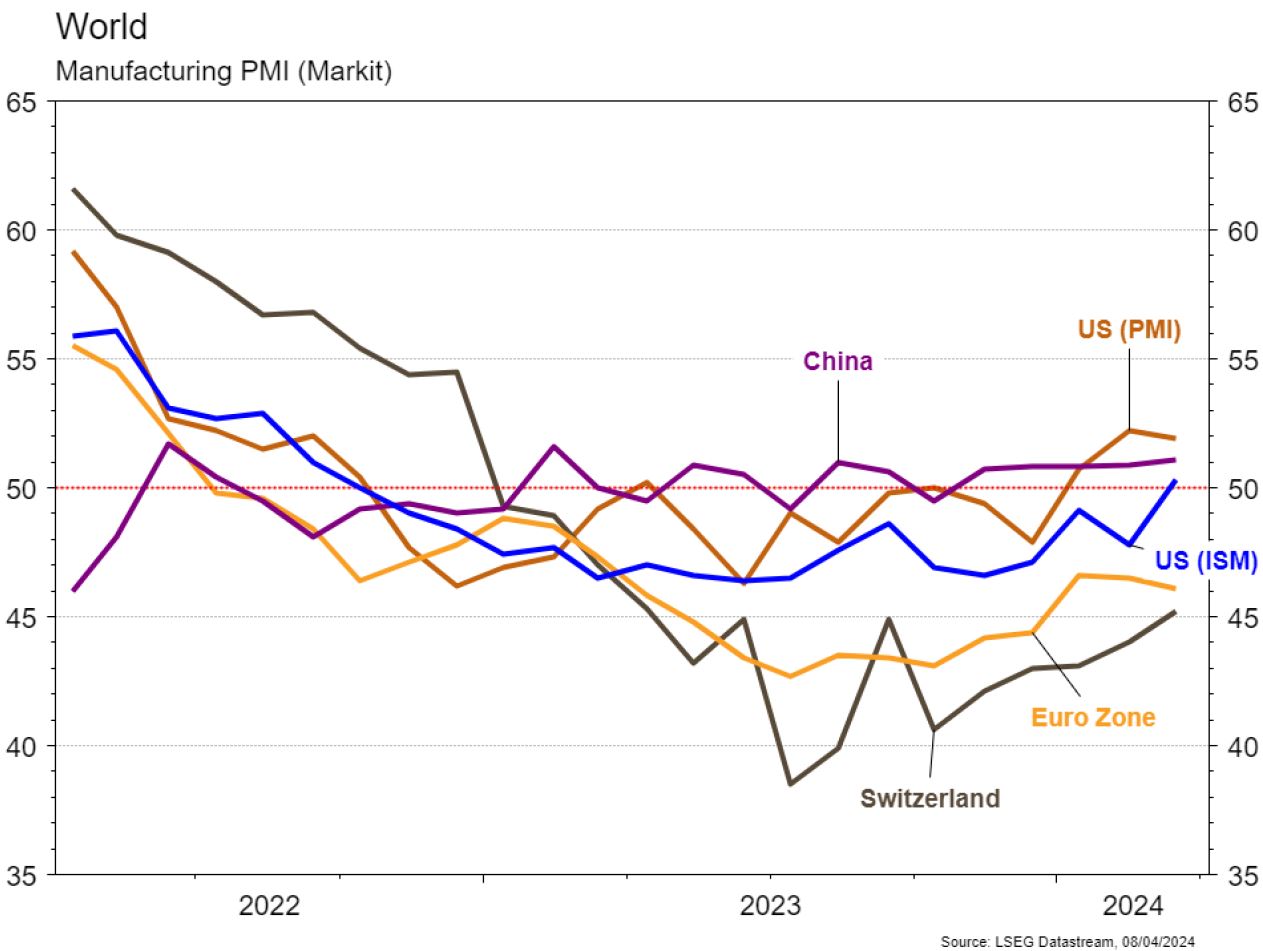

The statistics published in the United States were generally satisfactory. In particular, the US economy created more jobs than expected in March (303,000 vs 214,000 expected). The ISM manufacturing index also came as a positive surprise, rising from 47.8 to 50.3, which mitigated the disappointment of its services counterpart, which fell from 52.6 to 51.4, although a rise was expected. In the eurozone, inflation slowed faster than expected in March, from 2.6% to 2.4% y/y (and from 3.1% to 2.9% for core inflation). In China, purchasing managers' confidence improved from 49.1 to 50.8 in March in the manufacturing sector and from 51.4 to 53 in services, above consensus expectations.

Fed Chairman Jerome Powell has stated that climate change is not part of his mandate, which is factually the case, and that he is opposed to the Basel Committee imposing climate change reporting requirements on banks. There is also a difference of approach between Europe and the United States on this issue: the European institution is in favor of such a measure and is now carrying out climate stress tests to assess the costs of adapting to a low-carbon economy.

Geopolitical tensions on the one hand, and better business figures on the other hand, drove up oil prices (+4.7%) and gold prices (+4.9%). Sovereign 10-year yields are up ~20bp in the US and ~10bp in the eurozone. Equities are suffering (US: -1%; Europe: -1.2%; Switzerland: -2%) except in emerging markets (+0.2%). Finally, it should be noted that the dollar was fairly stable over the week (dollar index: -0.2%). Coming up this week: SME confidence (NFIB index), consumer price index, Fed minutes and household confidence (Univ. of Michigan) in the United States; ECB meeting and investor confidence index (Sentix) in the eurozone; foreign exchange reserves, monetary aggregates, consumer price index and trade balance in China.

Coming up this week: unemployment in March (Seco), accommodation statistics for February (FSO) and traffic statistics for March from Flughafen Zürich. The following companies are due to release figures: Bossard, Burkhalter, Barry Callebaut, Givaudan, Jungfraubahn, VAT Group, Helvetia and BC de Lucerne.

ASSA ABLOY (Core Holdings) has announced the acquisition of Messerschmitt Systems of Germany, which manufactures access control hardware and software for the hospitality market. The acquisition is expected to be slightly dilutive to earnings per share.

BYD (Satellite) sold 302,459 NEVs (New Energy Vehicles) in March 2024, up 46% on March 2023. Furthermore, the Group produced its 7 millionth NEV.

SIKA (Core Holdings) has acquired US-based Kwik Bond Polymers, LLC (KBP), a manufacturer of polymer systems for the refurbishment of concrete infrastructure. The company focuses on the rehabilitation of bridge decks and complements Sika’s high value-added product offering for the renovation of concrete structures.

SWISS RE (Satellite): surprise announcement last week of its CEO departure on 1 July after 8 years at the head of the group. He will be replaced by Andreas Berger, the current CEO of Corporate Solutions, a former thorn in the side of the group which he managed to turn around in five years. This internal appointment reflects continuity in terms of strategy.

Energy Sector: the IEA has revised upwards its projection for growth in world oil demand, to +1.3 mbl/d compared with +1.1 mbl/d previously. This is a boost for prices, in addition to the current tensions in the Middle East.

In the US, the better-than-expected ISM manufacturing report, combined with a solid employment report, pushed rates up (2Y +13bp/10Y +20bp). The "no landing" scenario is gaining momentum and the market now expects only c. 2.5 rate cuts in 2024. In the eurozone, inflation came as a positive surprise (2.9% y/y vs. 3% expected) but rates were influenced by the US movement (10Y Bund +10bp/BTP +14bp). Interest rate volatility had no impact on credit, with IG spreads continuing to narrow in Europe (-4bp) while US HY spreads widened slightly (+5bp).

Stock markets

The indices got off to a mixed start this week, as we await the first quarterly results (from the US banking sector on Friday). On the macro side, we will have CPI, PPI and the FOMC minutes in the US. The ECB meeting on Thursday will be closely watched, with no rate changes expected. The markets are nervous, with the expected rate cuts receding somewhat.

Currencies

The € at €/$ 1.0830 could come under pressure this week after stronger-than-expected US employment figures and the forthcoming CPI. The $/CHF has failed to break the $/CHF 0.9112 level, and a test of the sup. 0.8924 is possible. Rising geopolitical tensions could give the CHF renewed strength at €/CHF 0.9790, res. 0.9842 sup. 0.9690. The £ is consolidating at 1.2627, a break of res. 1.2675 is needed to resume uptrend; sup. 1.2500. Gold reaches a new all-time high of $2337/oz, sup. 2110 res. 2375.

This document has been issued for information purposes and is exclusively supplied by Bordier & Cie SCmA in the framework of an existing contractual relationship with the recipient of this document. The views and opinions contained in it are those of Bordier & Cie SCmA. Its contents may not be reproduced or redistributed by unauthorized persons. The user will be held liable for any unauthorized reproduction or circulation of this document, which may give rise to legal proceedings. All the information contained in it is provided for information only and should in no way be taken as investment, legal or tax advice provided to third parties. Furthermore, it is emphasized that the provisions of our legal information page are fully applicable to this document and namely provisions concerning the restrictions arising from different national laws and regulations. Consequently, Bordier Bank does namely not provide any investment services or advice to “US persons” as defined by the Securities and Exchange Commission rules. Furthermore, the information on our website – including the present document – is by no mean directed to such persons or entities.

insights

© 2024 Bordier & Cie

Please select your location and language below. If your location is not listed please select "International".